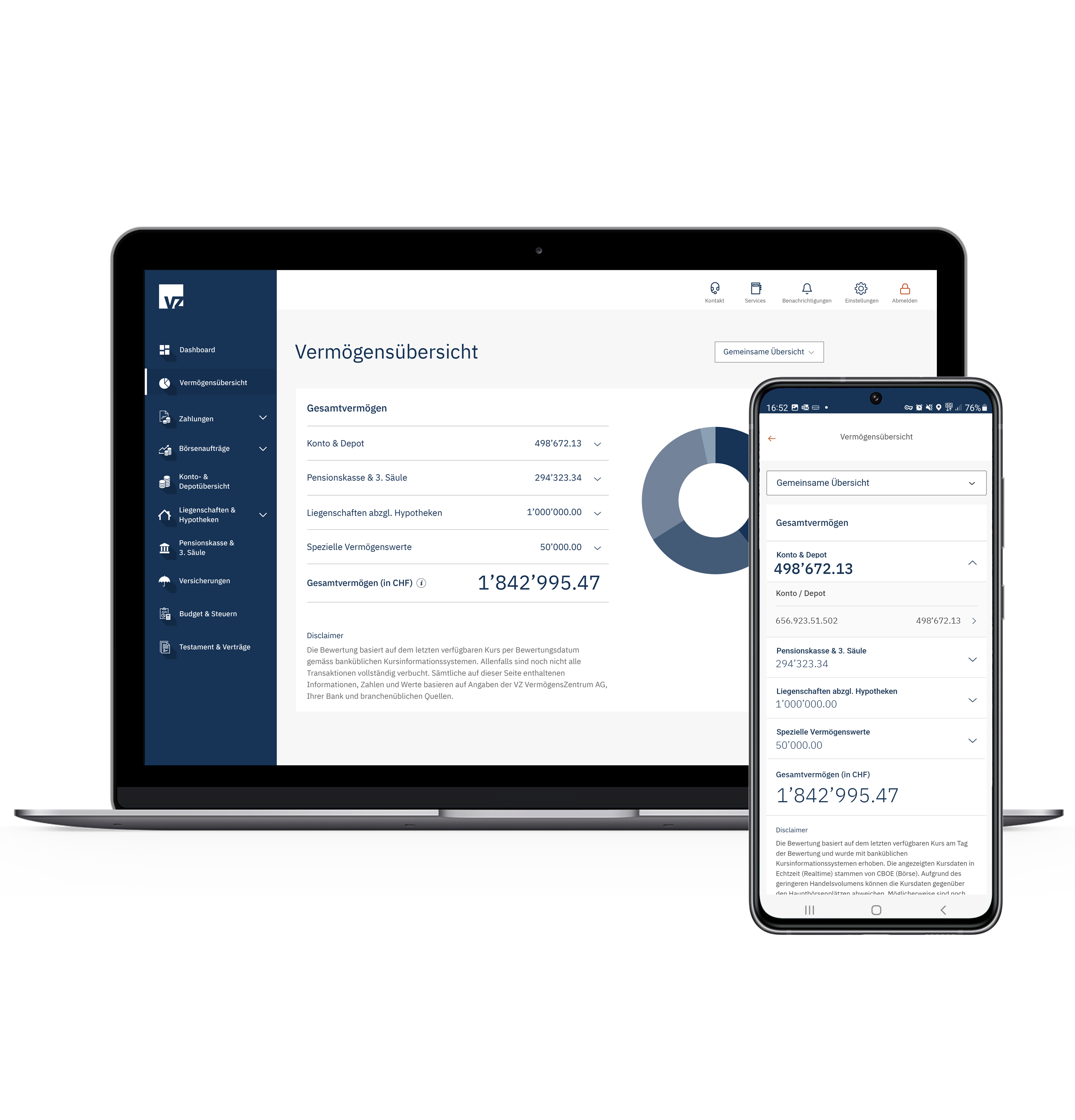

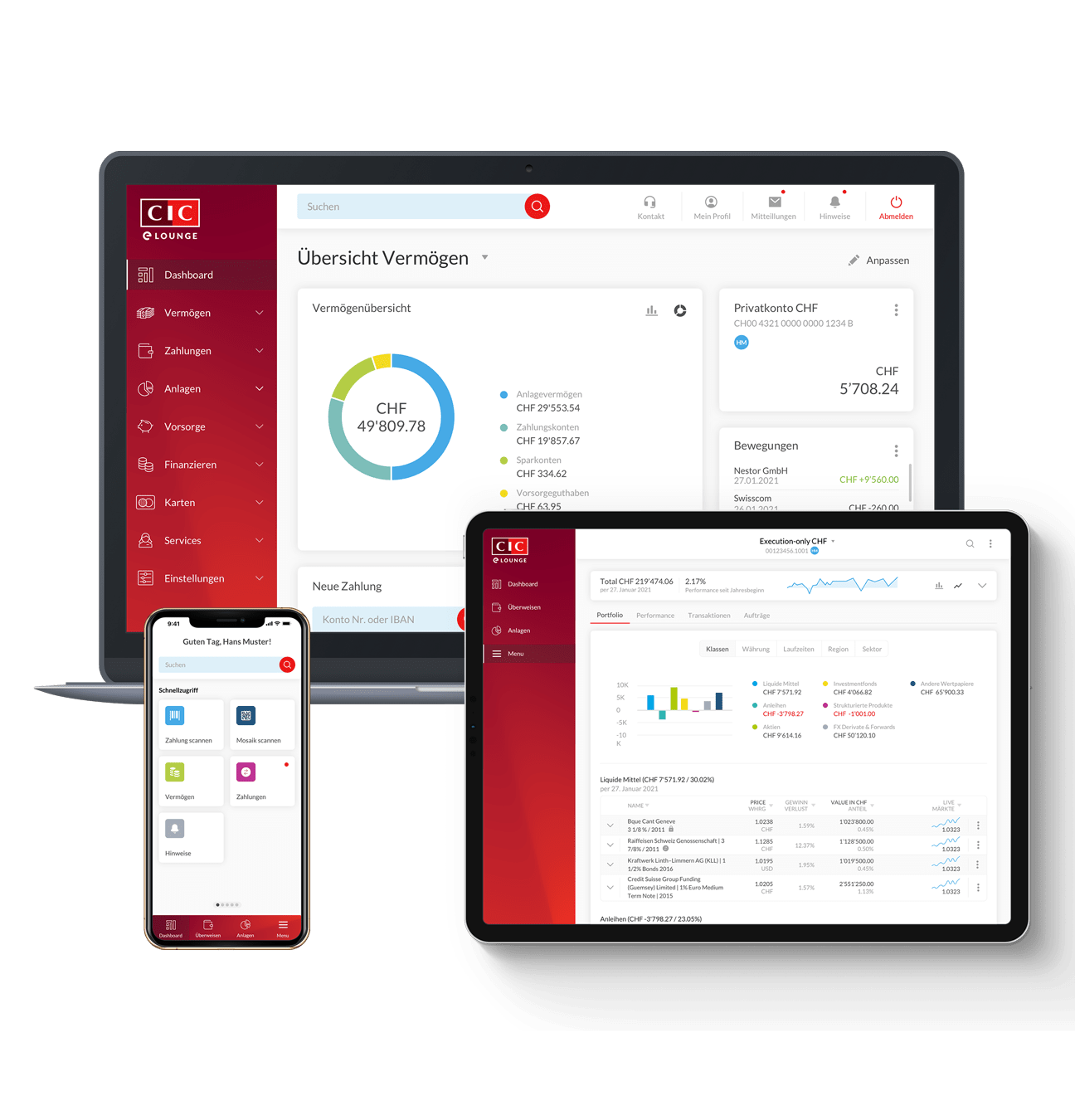

A flexible and personalized online banking experience

The modular setup of our ti&m Banking software allows you to adapt your services flexibly and efficiently to the needs of your customers. Create an enhanced user experience at every touchpoint. We combine our expertise and highly scalable technology with a customer-friendly and appealing design. Discover our digital banking software products in detail.

The core modules of our digital banking software products

ti&m offers various digital banking modules: from an entire online banking solution, ti&m Banking, to individual modules such as a 3A investment platform. These modules can be used separately or in combination.

ti&m Banking

Digital banking

Technology and integration

Integration solutions for core banking systems

Open Banking

Open Banking with ti&m

Digital identification

Digital onboarding

ti&m Trading

Trading platform

ti&m Card Management

Card management software

Future-proof banking software trusted by leading financial institutions

The strengths of our digital banking products

Seamless experience

Modular banking anywhere and on any device.

Leading technology

Superior technology as the basis for open innovation.

Hollistic design

Serve the entire value chain.

Developed by experts

High level of expertise in banking projects.

Discover ti&m Banking

Our success stories

Many banks are already using ti&m's software products.

Head of Products & Banking Innovations

Fabian Braunwalder

Ready to transform your bank with cutting-edge technology?