Banking is increasingly moving towards personalized customer journeys with content and products tailored specifically to customers or customer segments. At the same time, ecosystems and partnerships beyond company boundaries are becoming more and more important and enable banks to expand their offerings by extending the value chain. In the back office, the automation of complex tasks is becoming increasingly sophisticated: Processes such as compliance checks or risk analyses are being optimized, leading to better service quality and greater operational efficiency. All of these approaches are largely based on the intelligent and effective use of existing bank data. Banks have a very extensive and valuable database in their core banking system and in the ecosystems they have created. To implement use cases in the various fields of innovation outlined, it is essential to critically analyze the necessary data basis and seek ways to improve data usage.

Challenges in handling data

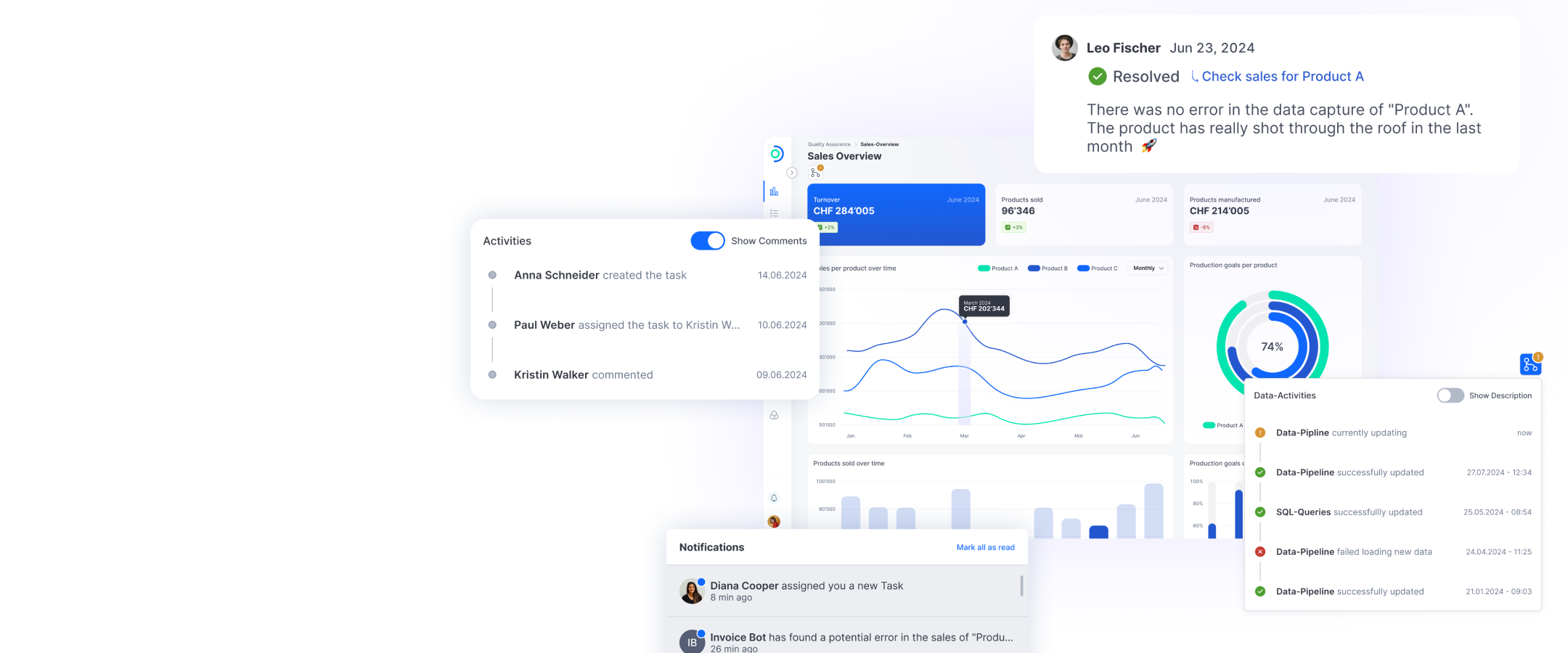

Besides identifying and processing the relevant data for possible use cases, the big challenge is to be able to access the data efficiently and effectively. At banks, the majority of customer-relevant data is stored centrally in the core banking system. However, access is often complex and cumbersome: Interfaces are needed to extract information from the core banking systems, and these usually offer inadequate response times and technical capabilities. In addition, more and more data also exists outside the core banking system. For a complete customer analysis, this data has to be merged with the core banking data in a correct and meaningful way. The problem: The monolithic structure of core banking systems is designed for stability and security, which makes it difficult to transfer data into flexible architectures. Legacy systems require specialized interfaces to provide data for external systems. Thanks to advanced integration solutions such as ti&m Banking Integration, banks can bring together previously dispersed data, gain deeper insights into customer behavior and use these insights as the basis for implementing use cases.

Interfaces with a flexible and configurative approach

Our efficient, microservice-based integration approach for core banking systems makes it possible to merge data from core banking systems and peripheral systems entirely through configuration and to adapt it precisely to requirements using flexible filter and restructuring functions. This enables quick and easy creation of customized APIs for specific use cases. This approach utilizes a reusable database for different services and requires hardly any additional infrastructure resources for further services after the initial installation, which considerably simplifies the development of new functionalities. Thanks to the configurable structure, developers and business stakeholders can work together quickly and efficiently. This in turn promotes productive feedback loops and accelerated coordination. With ti&m Banking Integration, we create modern data architectures that enable banks to extract and process data from core banking and peripheral systems and use it to develop new use cases by means of APIs.

White Paper: Agile data architectures

ti&m Special «digital banking»