Majority of existing core banking suppliers are horizontally integrated

The core banking systems currently used in Swissbanks at the regional and cantonal level are monolithic systems. Changes to data or features can come with substantial risks and additional costs.

Providers have grown over the years, developed new features, and integrated them into the resulting process landscape using a horizontal approach. These horizontally integrated core banking systems are built on the principles of stability and reliability. But new touch points and business models call for highly flexible systems that can be adapted to changes in the market and new customer requirements on an ongoing basis. The current trend toward open banking and the fact that processes are handled by multiple service providers present banks with further challenges in terms of their existing system landscape. The integration of new features from third-party providers and from in-house developments results in the coexistence of systems with varying levels of maturity and often in fragmented system landscapes. These are difficult to maintain, and modifications can only be made at great expense

Could neo-core banking systems be a potential solution?

Neo-core banking systems are designed in line with thelatest architectural principles and have flexible, standalone modules that can be used and combined with one another as needed. This highly modular approachis achieved by encapsulating functionality in microservicesand foregoing data storage in a central database.The modules are interconnected on the basis of API interfaces, ensuring maximum flexibility.

Neo-core banking systems focus on backend services that provide their functionality to the frontend applications via APIs. As a result, a customer interface can be custombuilt to meet the bank’s needs with as few logistical features as possible and integrated into the core modules using the available interfaces. A clear distinction can thus be made between frontend and backend functionality, so features can be implemented in a costefficient way. Neo-core banking systems make it possible to integrate services vertically thanks to their modular approach and by making services available along the banks’ value chain.

The modern architecture creates scope for expanding, integrating, or outsourcing functionality and step-by-step system migration as well as freedom and flexibility in terms of processes. This opens up new strategic scope for banks, including developing new business models.

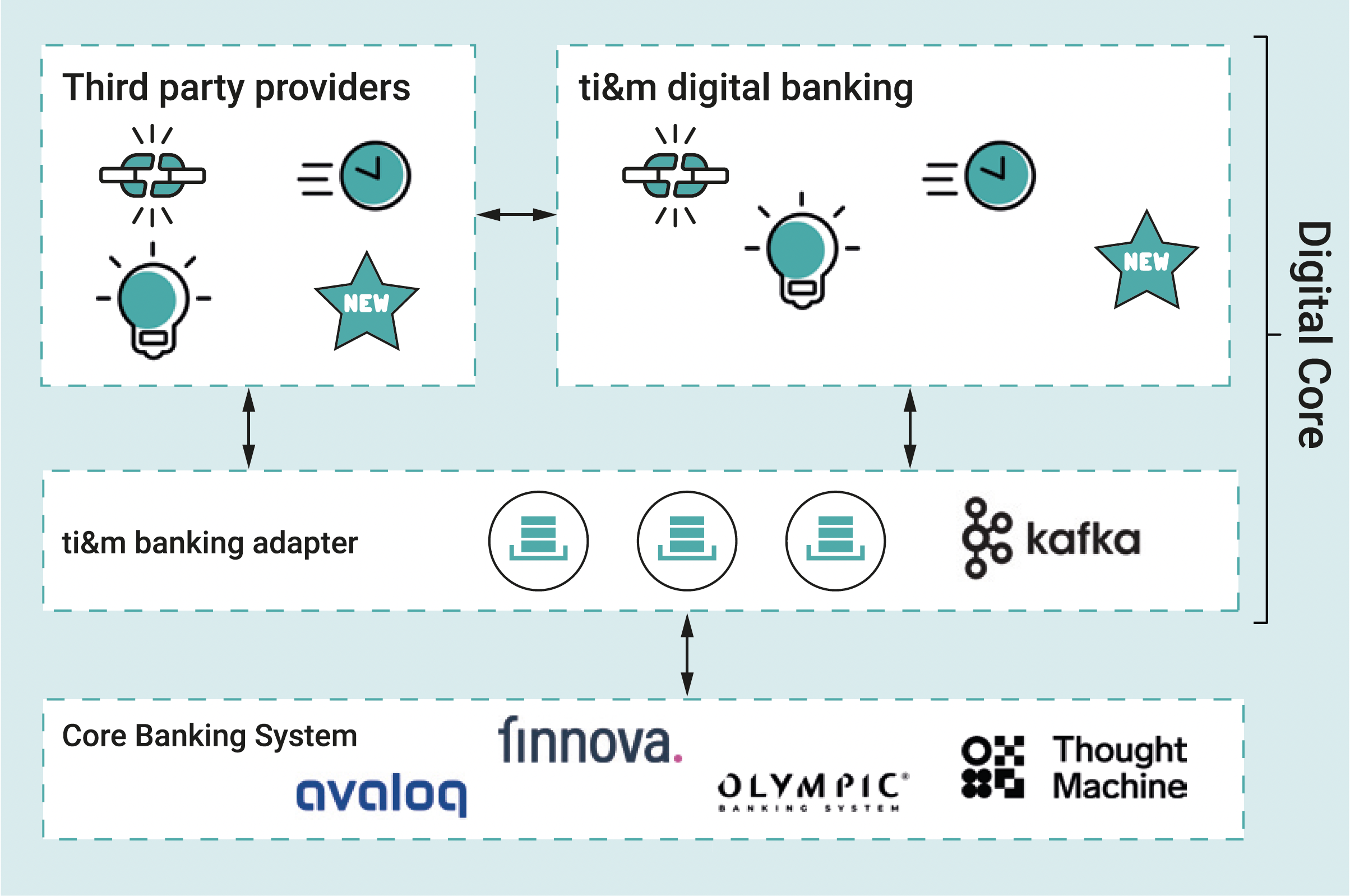

Example showing the architecture of a digital banking platform with an integration layer

Example showing the architecture of a digital banking platform with an integration layer

Five key principles for the architecture

Over the course of the many projects we’ve worked on, a few architectural principles have emerged that support the above scenarios:

01 Decoupling from the core banking system by means of microservices creates minimal dependency at the functional level.

02 Control over data, models, and services is consistently allocated to the professional domains. The professional areas can thus be decoupled, which also opens up the possibility of distributing professional expertise across a number of service providers.

03 Using a canonical data model, product modules from any desired third parties can communicate with each other effectively with a disconnect from the core banking system.

04 Open standards pave the way for interoperability and standardized integration.

05 Data is handled as a product – includingversioning, interfaces, documentation, catalogs, and availability, among other aspects.

The bottom line: there’s no such thing as a single right solution

Banks are starting from a challenging situation, with new business models and pressure to change. The problematictechnology base with the existing system landscape and the need for a suitable architecture inevitably lead to the use of various approaches in the context of implementation. Many banks are effectively locked intotheir core banking systems: it’s nearly impossible tojustify system integrations from a business perspective.

The increasing range of services of neo-core banking systems gives banks the opportunity to integratenew services from these providers or replace existing services in the current core banking system. This allows the bank to expand its range of services, make processes more efficient, and accelerate its digital transformation. Neo-core banking systems can provide banks with key support as they move into the new world of banking, but not on their own or without accompanying measures.

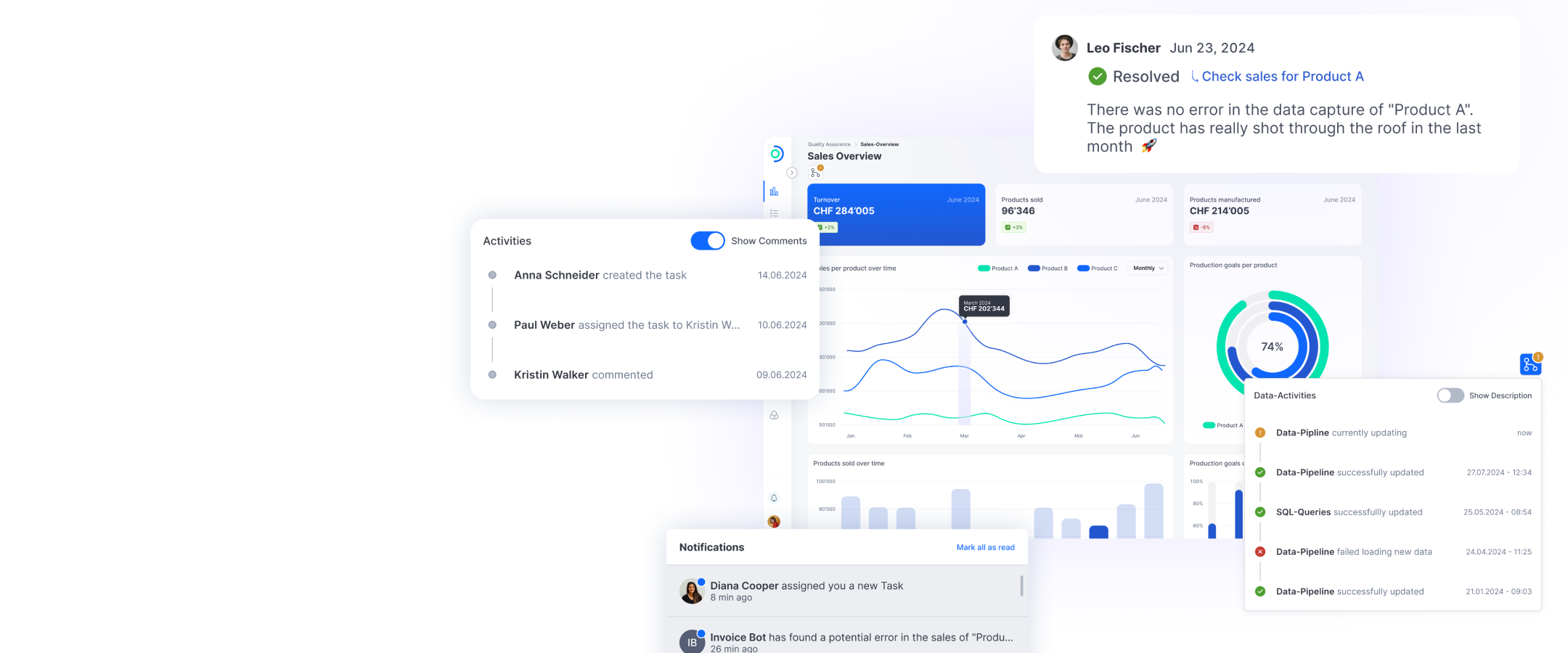

ti&m supports the development and integration of digital banking platforms

Our expertise in modular architecture, together with our extensive experience in projects involving core banking systems, create the ideal preconditions for tackling challengesin this area.

We support you as you move into the future of banking with product solutions such as the ti&m digital banking suite and ti&m banking integration as well as the expertise we have gained in many different projects.

Take advantage of maximum development opportunities for your digital platform, new opportunities to cooperate with partners and customers, and a shorter time-tomarket for your products and services. For you as a bank, decoupling at the data level means you retain the capacity to take strategic action for the future.