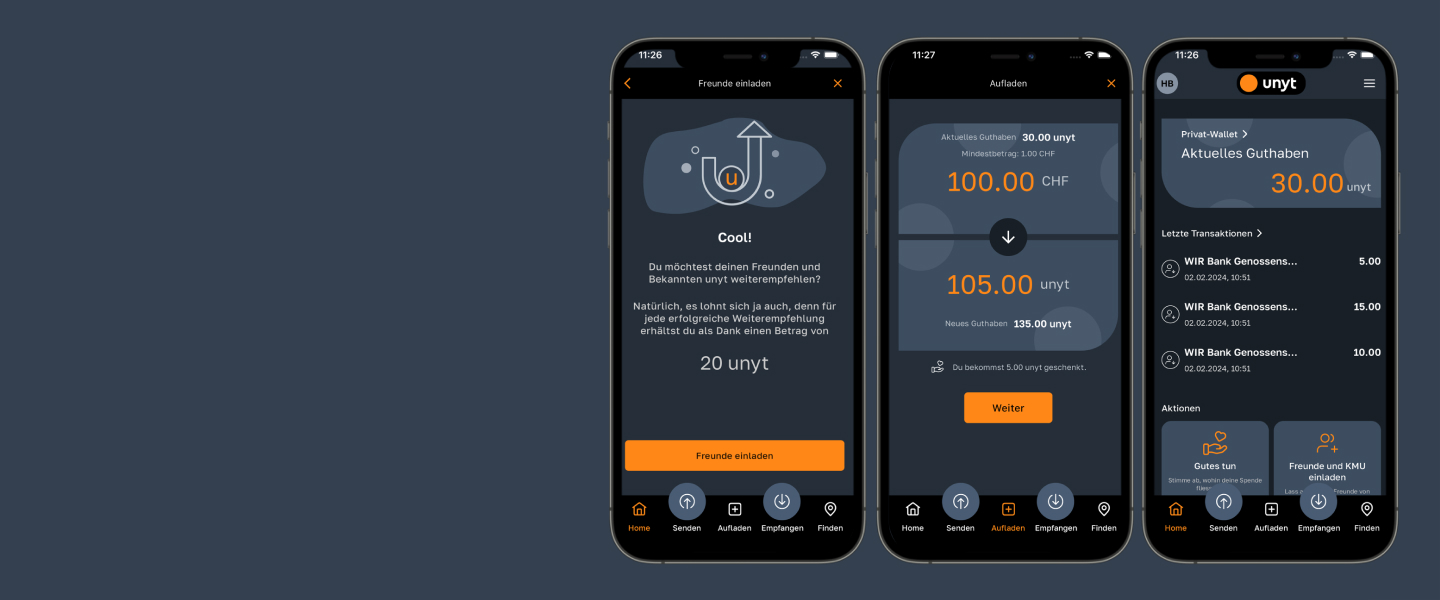

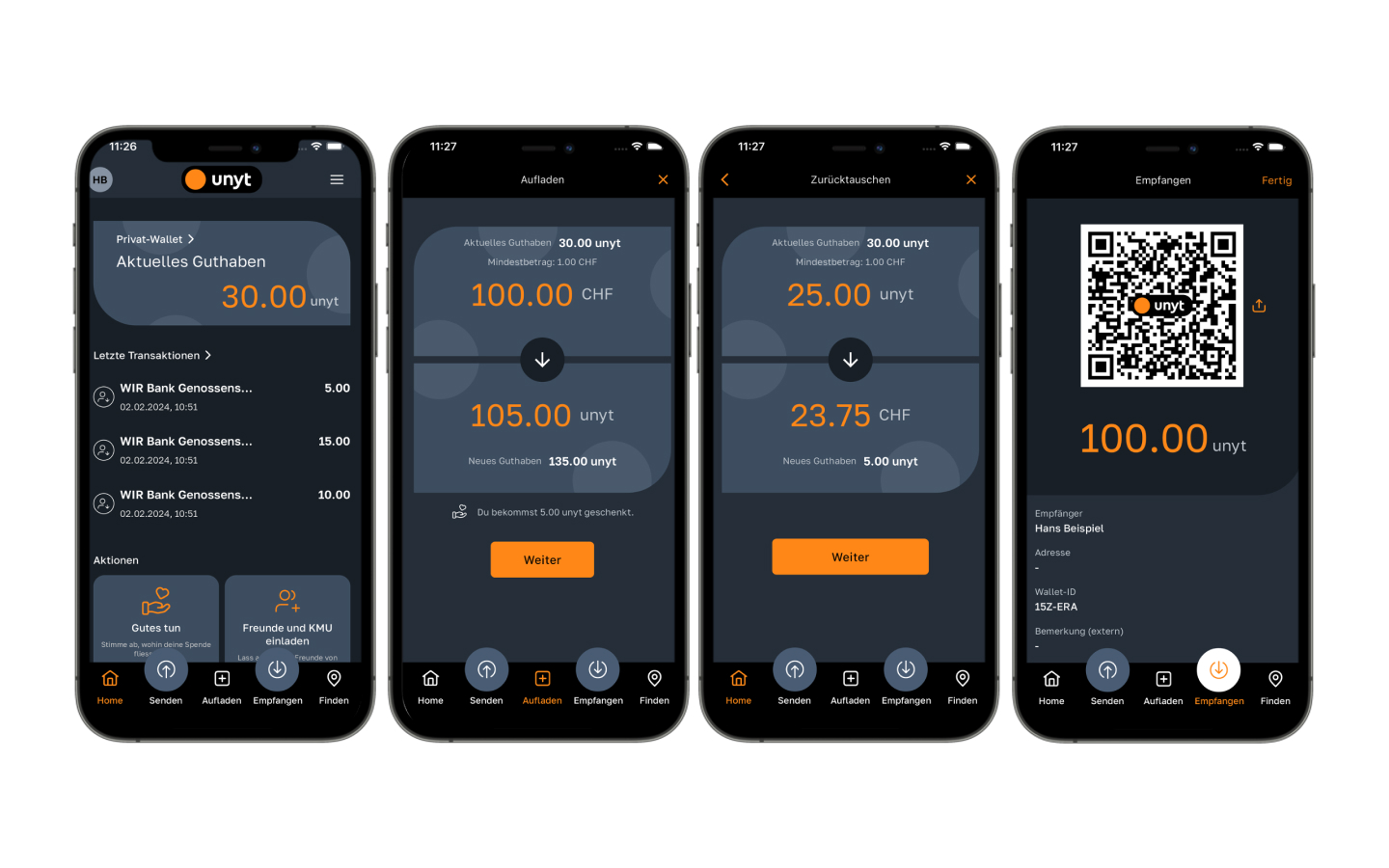

The digital currency for a growing active community of SMEs and private individuals is pegged to the Swiss franc and can be exchanged back at any time. unyt creates more purchasing power for the Swiss population, because exchanging Swiss francs for unyt automatically gives you 5 percent more: 100 CHF simply becomes 105 unyt. The digital currency thus strengthens the local economic cycle and Swiss SMEs – and supports charitable projects with every payment.

Stability

Increased purchasing power

An ecosystem for strong SMEs

Available anywhere via the app

Payments and more

Pay and do good

Complete implementation by ti&m

unyt is an in-house development by ti&m and comprises the app for customers (private and corporate customers), a back-office website for bank employees and a microservice-based backend (Quarkus Framework). We were responsible for the overall architecture and the complete agile implementation of unyt: branding and design with an intuitive user experience, requirements engineering including security, software engineering, backend development, admin web UI and testing.

The app was developed with the cross-platform Flutter for Android and iOS. The solution is hosted and operated by ti&m to ensure monitoring, auditability and security. Our experts also support our customers with questions on data protection, compliance and the selection of suitable technologies and products to successfully implement the project. The growing requirements that a payment solution with its own currency entailed from a regulatory perspective were a challenge that we solved flexibly over the course of the project.

With the digital currency unyt and the app, we have developed a technological ecosystem that can be flexibly and easily expanded with new functions.

Head Agile Projects Zurich

Dieter Abplanalp

Rethinking banking with creativity and technology: let’s do it together!