Most Swiss banks have not yet taken an active interest in data-driven banking. This is despite the fact that the potential of data analytics and artificial intelligence in banking is demonstrably recognized by industry experts in Switzerland, as shown by existing surveys on the subject. However, in order for Switzerland to remain competitive and one of the world’s leading financial centers in the future, the industry must continuously and dynamically adapt its business models to changing conditions. The most important drivers for data-driven banking are technological and regulatory factors. Specific use cases for the various levers to improve business performance (i.e. minimizing costs, reducing risks or increasing turnover (Fig. 1)) can be derived from these.

Drivers and use cases of data-driven banking (source: IFZ)

Drivers and use cases of data-driven banking (source: IFZ)

Technological drivers push banks towards a data-driven future

Technology is, obviously, the key driver for data-based banking. The drivers that are considered particularly relevant for the Swiss financial industry enable flexible scaling, a standardized and thus efficient form of interaction between different providers, and the latest methodological approaches. The fundamental resource of all three technological drivers is data, on the basis of which financial institutions can create added value for themselves and their customers. The data available to Swiss banks can be divided into three main types: Master data (including customer data and socioeconomic data), transaction data (e.g. payments, trades) and behavioral data (e.g. interactions across different channels). The challenge often lies in setting up a suitable IT infrastructure and a data management system that collects and stores data using appropriately large computing power from various (internal) sources. The leap in technical possibilities brought about by AI research has led to a host of new innovations and business cases. The main factors driving this process are innovations in deep learning, a rapidly growing amount of available data and access to relatively cheap computing power (e.g. via cloud computing). In Switzerland, many banks are already using AI in one or more business cases. In addition, a growing number of Swiss fintechs are also using AI.

Regulatory aspects are not an impediment

The regulatory framework of the Swiss financial sector comprises various federal laws and implementing regulations. The two most important provisions are:

Data governance: The potential value of data sharing must be weighed against the implications in terms of data protection, data security and control over competitive data. Technologies that improve data security enable the protection of sensitive data, can reduce concerns about data sharing and increase trust in institutions.

Regulatory compliance: Regardless of the type of cloud used by financial services providers (private, public or multi-cloud), the data hosting infrastructure and control framework must meet the regulatory requirements of the Swiss Financial Market Supervisory Authority FINMA. However, the existing provisions in Switzerland are not an impediment to the outsourcing of business processes (including data analysis or storage of data in the cloud, even abroad).

Therefore, from a regulatory point of view, the prerequisites for data-driven banking would be met for Swiss banks.

Huge potential in many banking areas

The application of data-driven banking can have a positive impact on the businessperformance of banks through three main levers. First, use cases such as automated customer onboarding or automated screening of potentially politically exposed persons can reduce costs for financial institutions. Second, business risks in banking can be minimized through data-driven insights (e.g. in the area of lending, through more accurate default forecasts). And thirdly, in addition to potential improvements on the cost and risk side, data-driven banking can also benefit the revenue side. Concrete applications such as recommendation systems can help financial institutions to increase their revenues through up- and cross-selling, higher conversion rates and less customer churn. But customers also benefit directly, for example through better personalization and customer experience, which in turn leads to higher customer satisfaction.

The road to data-driven banking

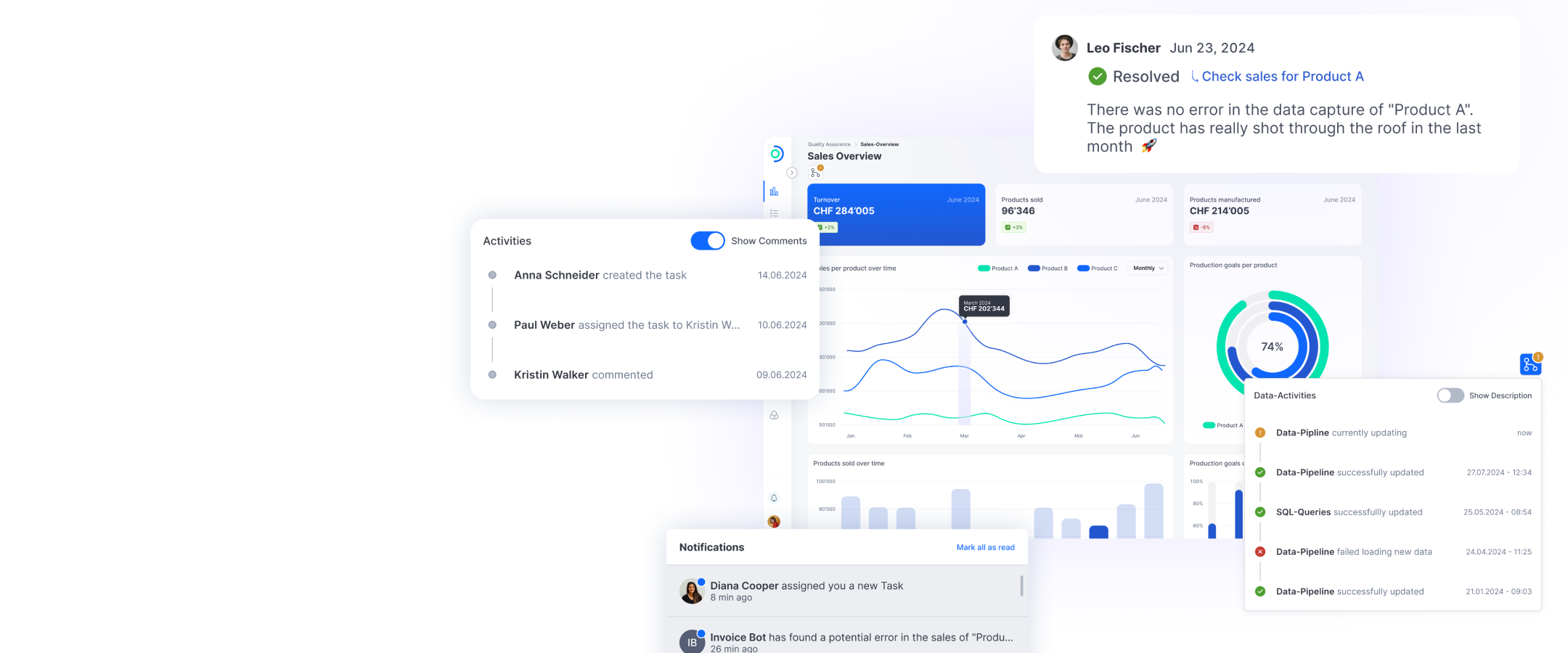

Due to the perceived high complexity and long implementation times of data-driven banking, smaller banks in particular shy away from exploiting its huge potential. However, the transformation can take place gradually, based on an organized approach that helps to continuously gather and apply experience. An approach to developing MVPs (Minimal Viable Products) in collaboration with specialized technology providers is particularly suitable when the necessary skills are not available internally (Fig. 2). In some use cases that add particular value for the bank, this can lead to initial results within just a few weeks, which in turn can serve as the basis for further developments on the road to data-driven banking. Banks should simplyventure to take the first step, because in Switzerland the necessary conditions – both technological and regulatory – are in place.

It’s all a matter of the right attitude

The technological and regulatory prerequisites for a transformation towards datadriven banking are in place in Switzerland. However, in order to successfully implement use cases, Swiss banks need to fundamentally change their attitude. The frequentlyprevailing compliance mentality, which in many cases prevents or at least slows down innovation, must make way for a technology- and data-friendly culture in order to be able to exploit the full potential of data-driven banking within the given legal framework.

MVP approach (Source: White paper “Data- Driven Banking”, IFZ, ti&m, Google Cloud, 2022)

MVP approach (Source: White paper “Data- Driven Banking”, IFZ, ti&m, Google Cloud, 2022)