In our white paper “The Future of Customer Advisory in Banking”, ti&m used six hypotheses to examine the direction in which theneeds of customers, the technical possibilities, and ultimately the advisory process will develop in the course of digitalization. The first hypothesis articulates the expectation that the penetration of digital services, as experienced by customers in all areas of life, will not stop at banking transactions.

Hypothesis #1

As soon as a service offers customers real added value and simplification, customers are willing to take advantage of new offers. This also applies to banking products; hence, digital services will continue to change banking.

As a result, banks should refocus on the development of digital services, because in recent years their initial pioneering role in digitalization has been lost. But how far can banks reasonably take this? How can banks deliver advisory and support services which differentiate local banks from international and domestic neobanks and fintech challengers?

Hypothesis #2

Digital touchpoints have an increasing relevance in banking. There is a (growing) group of customers who only want to have digital contact with their bank. This development also affects the advice provided to bank customers. The importance of in-branch services is decreasing; advisory can also be provided via alternative channels.

An in-depth analysis of customer types, their relationship with the bank and its advisory services shows that there is definitely demand for digital service delivery on the part of the customer. So far, however, corresponding provision from the banks is lacking.

The market is moving

Yet why should banks consider this customer requirement as a serious trend that has the potential to have a lasting impact on their strategy and business model? After all, the profitability of the banks has been excellent in recent years and the loyalty of customers seems consistently high. This inference is deceptive. There is a lot going on under the surface that will have an impact in the near future.

Hypothesis #3

Banking in Switzerland is in flux. Big Techs, neobanks, third-party providers and larger banks are stepping up their activities. The apparent loyalty of customers to their bank is merely a consequence of high switching costs and a lack of alternatives. Once these are in place, the willingness to switch will increase.

The study specifically examined the performance of the neobanks and the Big Techs, whose market logic is strongly based on therapid growth of the customer base. The market is being challenged with focused services that quickly deliver added value tocustomers. Profitability is not a priority initially and follows, once a wider range of services can be offered to a larger customer base. The market for financial services, and thus the competition for customers, is therefore becoming more intense – and will be determined in the digital world.

Hypothesis #4

Advising customers will become important for neobanks and Big Techs, as this is in line with their development logic, and they willneed to move into higher-margin areas of business. In doing so, they are targeting the consumer market, aiming to win them over with convenience and price.

The fundamentally different initial situation, orientation, and objectives of established institutions compared to the newcomers formthe basis of the analysis, which ultimately feeds into the recommendations for action for established banks. In addition to thebehavior of the customers, their relationshipwith the bank – or more precisely their trust in the bank – is the decisive factor here. The trust advantage enjoyed by establishedbanks and institutions will diminish in the foreseeable future.

Hypothesis #5

The trust that customers have in the support provided by banks plays an important role and is a basic prerequisite for customers to make use of advisory services. Trust is in a state of flux, and is increasingly placed in platforms rather than institutions.

A particularly interesting sociological insighthere is that trust reduces at least the subjective perception of complexity. Customers who trust in their advisor will therefore also accept complex products because they trust that the advisor understands these complexities and will use this knowledge for the benefit of the customer. Seen in this light, well-positioned personal advisory expertise would be a sustainable success factor, onein which the established institutions can score points. Unfortunately, this hypothesi does not hold up on closer inspection, because the supposed complexity of the products turns out to be merely “complication.” Only by linking various “complicated” individual products and topics such as financing, pension provision, and financial planning do services become complex, as the effects of individual decisions on the overall situation can no longer be predicted. It is important to connect with customers when dealing with these complex subjects. After all, selling products is something others can do as well, and products sell even when the level of trust is low.

Hypothesis #6

New competitors will simplify what needs to be simplified. The distribution of standardized banking products and services will thus shift to new providers as an increasingly large group of customers wants to operate independently. The established banks are therefore faced with various tasks: on the one hand, to meet the need for self-service and, on the other hand, to provide customers with expert, comprehensive and holistic advice.

High touch supplements high tech

Based on these six hypotheses, there are possible courses of action for banks in thecontext of their respective strategic orientation. From intensifying personal advisory services and expanding the problem spaceto focusing on purely digital self-service, the white paper looks in detail at various options and examines their competitive suitability as compared with start-ups and Big Techs.And as is so often the case, it is a middle course that promises the greatest success: hybrid advisory services. In addition to the personal advisory expertise they have builtup over the years, institutions are developingdigital touchpoints with their customers. At the same time, the consistent simplification of products can knock the wind out of the sails of many a start-ups. Whether inperson or digitally, customers must ultimately receive exactly the advice they expect in their current situation – “high touch supplements high tech”.

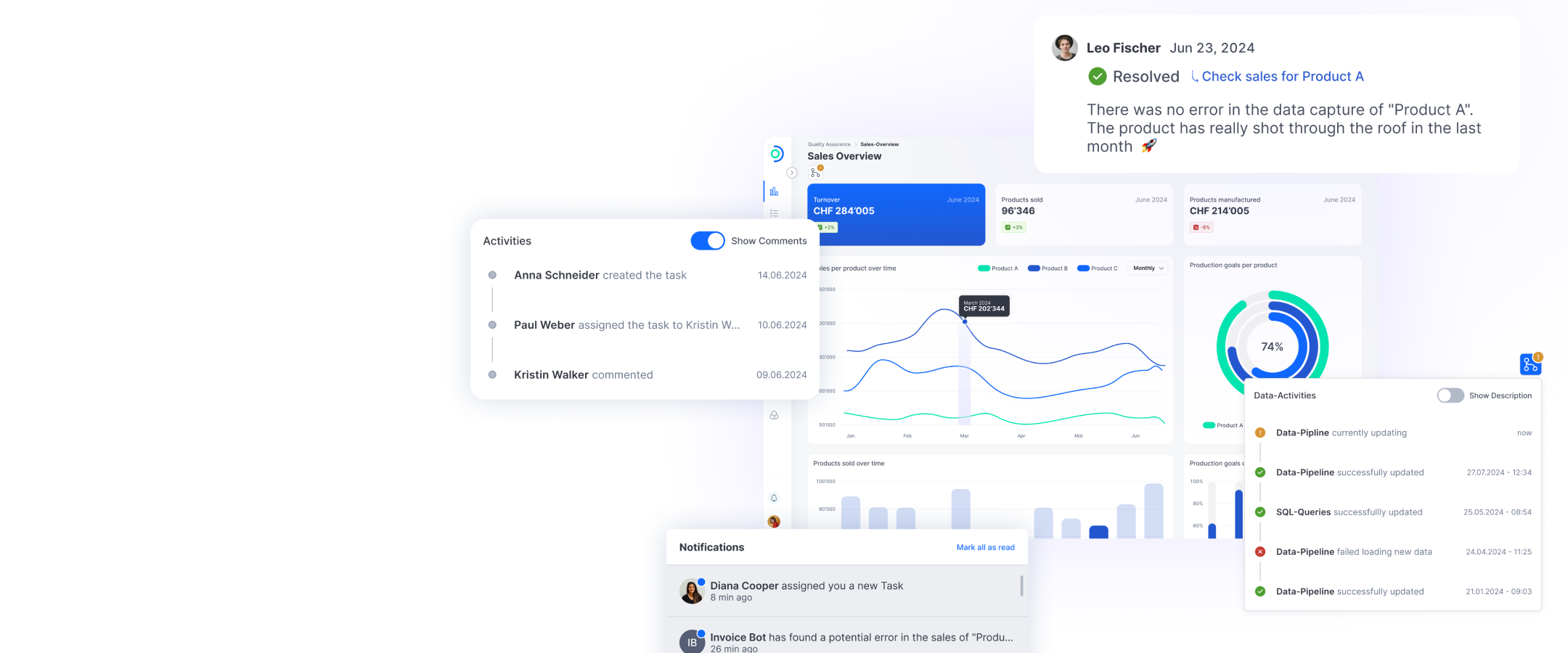

Technology as the basis

In addition to the banks’ core competencies, this hybrid approach also requires technological competence. Flexible IT architectures must adapt to the ever-changing expectations of customers, and it mustbe possible to integrate new technologies such as artificial intelligence or crypto applications in a quick, secure and stableway. This is where ti&m comes in: with its range of state-of-the-art banking productscombined with the experience gained fromhundreds of implementation projects in the Swiss banking sector, it is the ideal partner for a partnership-based development of advisory solutions.

Hybrid advice as a success factor for banks

Digital affinity is growing even among older customers, and neobanks are surging onto the market with simple, user-friendly and, most importantly, affordable services. In the white paper on hybrid advice, banking expert Stefan Rüesch explains what this means for customer service and how banks can address the new reality head-on.