“What a company fancies producing is not crucially important for success. What customers fancy buying, what they find value in, that’s what matters.”– Peter Drucker, Management Consultant

Management pioneer Peter Drucker has influenced many managers in the finance industry with this idea. Banks and other financial services providers realized that their traditional package of an account, card, and credit line doesn’t meet their clients’ needs directly. It’s more a means to an end in fulfilling their dream of owning a home or having financial autonomy. So they developed a strategic goal of offering integrated client solutions that give clients real added value. Holistic one-stop financial solutions aren’t a new idea though. As long ago as the turn of the millennium, banks and insurance companies teamed up as ‘bancassurance’ providers, but ultimately failed when it came to realization. Are we now seeing a return of this idea?

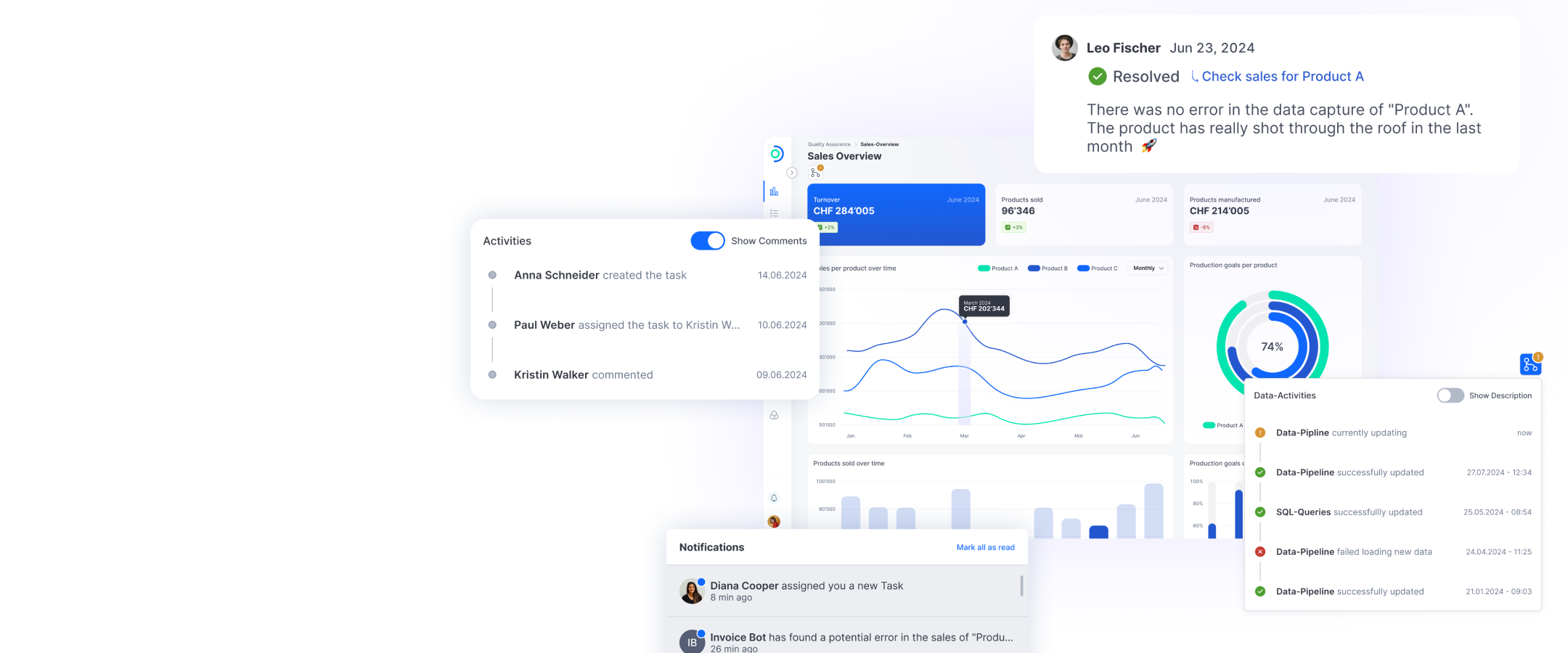

Yes, but with one key difference — the new solutions are based on digital ecosystems, not on integration through mergers and acquisitions. Through standardized data exchange, whether voluntarily or as a statutory requirement (i.e. PSD2), various products and services can become components within a digital ecosystem and therefore be combined into new value propositions. Companies within a digital ecosystem work together as partners. The collaboration is led by an orchestrator who defines and manages the underlying platform and interfaces. The partners whose offerings are part of the ecosystem are known as complementors.

Digital ecosystems as a form of organization for integrated solutions offer new opportunities for value creation. They allow unprecedented width and breadth of services reaching beyond company and industry boundaries. Ecosystems also provide client-specific and efficient integration of services, including through processing large amounts of data. Despite all their potential, digital ecosystems still run the risk of repeating old bancassurance mistakes. In the last ten years, several ecosystems have been established around the dream of home ownership. But currently, many companies are finding out how hard it is to identify and monetize a core interaction with added value for the customer. The once boundless optimism is dwindling among many banks and fi nancial services providers when it comes to building their own digital ecosystems. Yet being able to position oneself strategically in competition with and among one’s partners is becoming more and more essential. To establish integrated solutions based on ecosystems that will last, financial services providers must manage three challenges.

01 More offers + technological openness ≠ client benefits

An ecosystem must create real added value for clients. The client benefit of the ecosystem must offer more value than the sum of its parts. So simply combining several offers is not enough, even further along the value chain or as part of the customer journey. Expanding products based on technical opportunities, as software systems or APIs allow, is also not suffi cient. Ecosystems like that often don’t address a relevant cus- tomer need. So how can we create client benefi ts that really add value? It’s rarely possible to defi ne these on the drawing board. Countless experiments are needed to fi nd a core interaction that meets a client’s needs exactly. When you finally identify the core interaction, that’s when it makes sense to build the ecosystem around it.

02 Competitors? Partners? Or both?

To resolve the first challenge, banks and fi nancial services providers need to learn co-innovation. The ability to create value for and with partners is not a given, especially for large companies with a long history of success. It’s important to accept expertise from other companies and use this to create a foundation of trust for discussions on equal terms. Collaborating with competitors and businesses from other sectors is also key to making progress with integrated solutions. Financial services providers experience certain difficulties when selecting partners. Financial services are relevant to so many areas of life that it can be tough to fi nd an area for collaborative focus. What’s more, the strictly regulated environment makes it harder to experiment and share data. In many cases it’s therefore necessary to separate ecosystem initiatives from the core business to lay the foundations for co-innovation.

03 Orchestrator or complementor — finding the right role

Lastly, companies need to maintain control over collab- oratively developed ecosystems. The danger is that individual companies’ financial products can become components in a digital ecosystem controlled by others. There’s a risk of losing access to clients and data. For banks, there are two ways of retaining control. On the one hand, you can try to build an ecosystem where you’re the orchestrator. This requires justifying to partners and clients why you’re best placed to take on this central role and how you’ll create added value for all ecosystem participants. Having a strategy as an ecosystem orchestrator promises high profits but also entails high risk. On the other hand, as a complementor you can also identify successful strategies. This should be a strategic must for financial services providers, since in the long term banks rarely manage to stay successful in direct competition, particularly with global mega-ecosystems like Meta (Facebook), X (Twitter) or Apple. Successfully handling these strategic challenges posed by digital ecosystems will be essential in the long term to remain competitive.