A study by the Institute of Financial Services Zug (IFZ) atLucerne University of Applied Sciences and Arts has ranked VZ VermögensZentrum as one of the best retail banks for digital services. A new entrant, the Swiss financial services provider made the top 10 for digitalization. Working closely with VZ VermögensZentrum, ti&m implemented the new, expanded digital offering based on existing e-banking and onboarding products; a new and innovative trading platform was also developed for the Financial Portal Pro.

Financial Portal: the individual ti&m digital banking suite for VZ VermögensZentrum

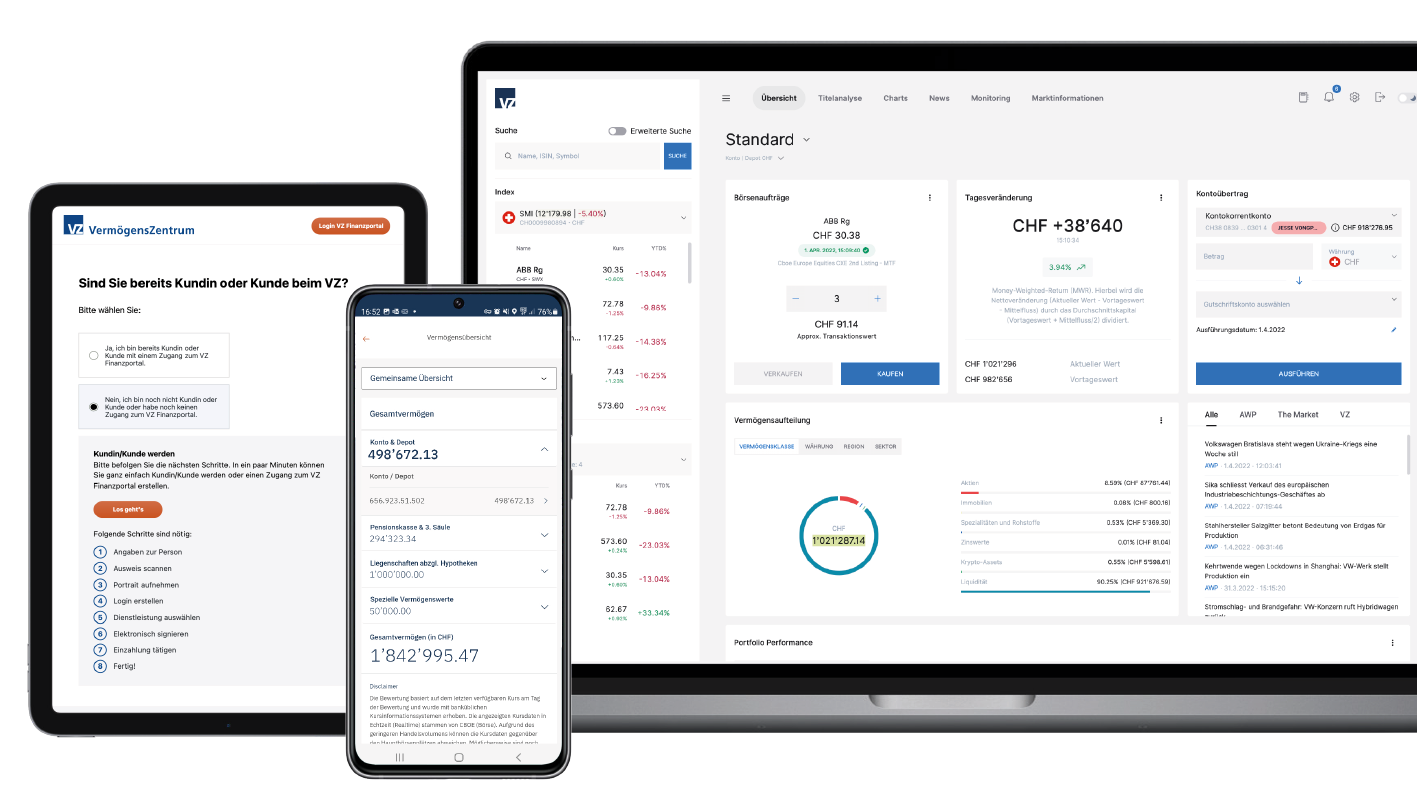

The first part of the digitalization strategy was to refresh the existing e-banking solution. VZ VermögensZentrum had a varied range of products and services that it wanted to supply to its customers digitally. Similarly to other projects, ti&m pursued a consistent front-to-back approach over the 12-month implementation period: The benefit, usability and the range of functions for end users were at the forefront. The new VZ VermögensZentrum Financial Portal is a modern e-banking portal offering numerous self-service functionalities and a clear and intuitive UX for smartphones and desktops. For ti&m, front-to-back also means separating the core banking system with the front end. This is the only way to respond promptly to market changes and new customer requirements, through the simple integration of new modules and third-party services. The open architecture enables new features to be implemented in a rapid time-to-market and lays the foundation for future-proof multi-banking services in a changing financial world. The modular product range of the ti&m digital banking suite formed the functional and technical basis for a customized solution to be developed in close collaboration with VZ VermögensZentrum, taking into account the customer’s legacy as well as their requirements.

Financial Portal Pro: an innovative joint project

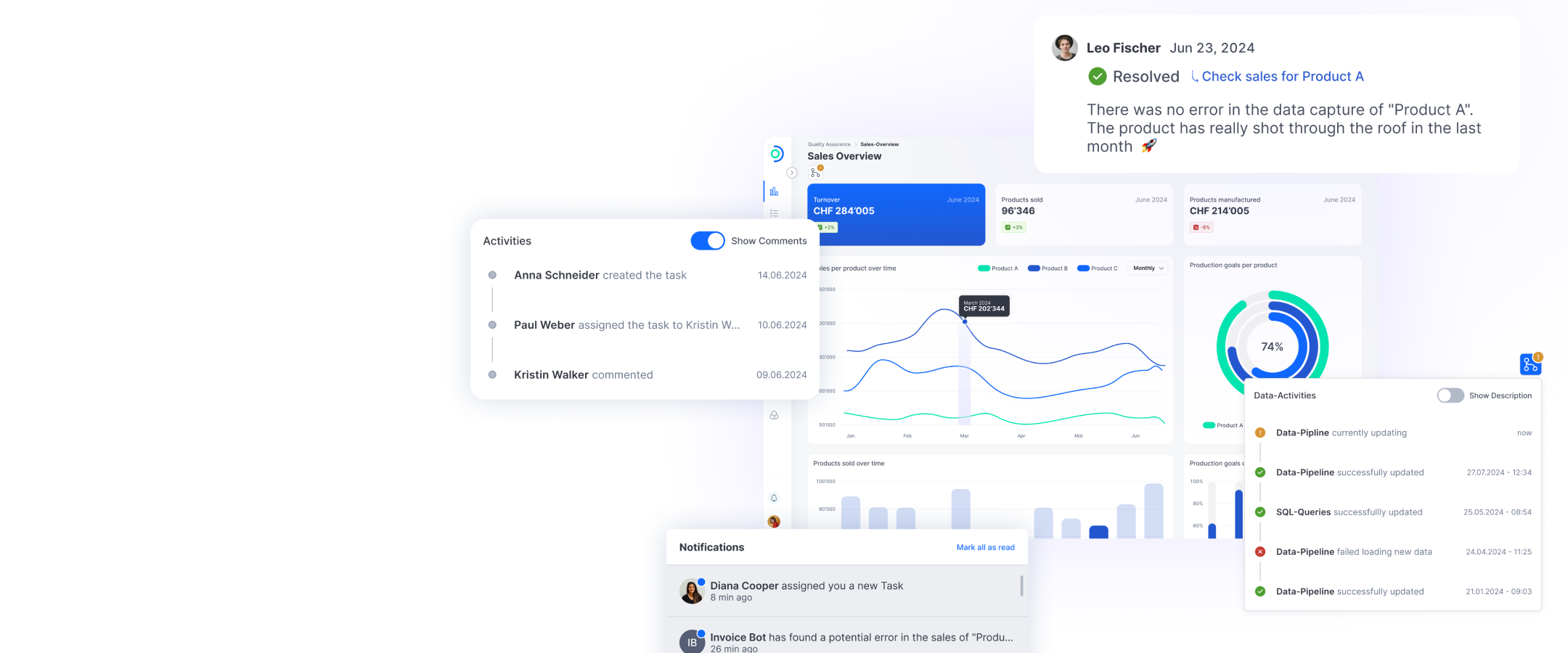

Interest from private customers in trading has grown strongly in the last few years, not least due to the emergence of cryptocurrencies. In addition to the new financial portal, where customers can go about their usual banking business, VZ VermögensZentrum wanted to give its customers easy access to the trading world by means of a new platform. In a joint innovation project by ti&m and VZ VermögensZentrum, the Financial Portal Pro was created, a trading platform that combines numerous functions and infotainment features in a unique UX. The user-friendly interface and broad set of features offers newcomers an easy introduction to the world of trading and gives professionals tools that can rival any neobank trading app: The integration of finance and news portals offers news and insights into markets and specific securities, while market information on different assets such as shares, interest rates and currencies, as well as portfolio reviews, can be viewed in real time. Users have the opportunity to set up their own trading platform as they wish, by adding or removing specific modules using the drag ‘n’ drop function. In addition, assets can be displayed according to user-defined parameters: view by asset class, by development for the current day, by historical performance, or as a detailed list of positions. Like the Financial Portal, the Financial Portal Pro was developed using an open architecture: Existing solutions by WebFG and TradingView are already integrated into the platform, while further frontend modules, so-called widgets, can be developed by various parties without any specific technical specifications and made available to the user having been registered centrally in a repository. Last but not least, a seamless connection to the core banking system reduces pressure on the back office. While the Financial Portal Pro project was being implemented, the newly developed solution was packaged into a new product: the ti&m trading suite. Following the successful introduction at VZ VermögensZentrum, ti&m’s modular Trading Suite, which takes just a few months to launch and seamlessly integrate into existing software environments, is also available to other financial service providers.

Digital onboarding: fast and secure new customer registration based on the ti&m onboarding suite

A customer’s first contact with their bank is crucial. When working from home, digital natives expect a smooth, simple and fully digital onboarding process. In a third stage, the ti&m onboarding solution was therefore rolled out for new customers and insurance customers who do not yet have an account with VZ VermögensZentrum. The entire end-to-end online identification process, with document scan and liveness check, is fully automated and AI-supported. The next step for VZ VermögensZentrum is to conduct a compliance check (checking compliance with anti-money laundering regulations and guidelines concerning politically exposed persons), and to decide whether or not they wish to accept the new customer. Lastly, the contracts for opening an account are issued via the in-house contract platform and shown to the customer. If the customer agrees, these can be signed digitally by timestamp. Particularly for banks, digitalization and the automation of the resource-intensive new customer registration process offers a wealth of potential.

The onboarding solution implemented for VZ VermögensZentrum is based on the ti&m onboarding suite. Online identification is available in two versions: As a fully automated online ID service, as in the case of the implementation for VZ VermögensZentrum, or as a video ID service, in which a bank employee or call center verifies identity via video call.

Finanzportal: die individuelle ti&m digital banking suite für das VZ VermögensZentrum

A study by the Institute of Financial Services Zug (IFZ) atLucerne University of Applied Sciences and Arts has ranked VZ VermögensZentrum as one of the best retail banks for digital services. A new entrant, the Swiss financial services provider made the top 10 for digitalization. Working closely with VZ VermögensZentrum, ti&m implemented the new, expanded digital offering based on existing e-banking and onboarding products; a new and innovative trading platform was also developed for the Financial Portal Pro.

Financial Portal: the individual ti&m digital banking suite for VZ VermögensZentrum

The first part of the digitalization strategy was to refresh the existing e-banking solution. VZ VermögensZentrum had a varied range of products and services that it wanted to supply to its customers digitally. Similarly to other projects, ti&m pursued a consistent front-to-back approach over the 12-month implementation period: The benefit, usability and the range of functions for end users were at the forefront. The new VZ VermögensZentrum Financial Portal is a modern e-banking portal offering numerous self-service functionalities and a clear and intuitive UX for smartphones and desktops. For ti&m, front-to-back also means separating the core banking system with the front end. This is the only way to respond promptly to market changes and new customer requirements, through the simple integration of new modules and third-party services. The open architecture enables new features to be implemented in a rapid time-to-market and lays the foundation for future-proof multi-banking services in a changing financial world. The modular product range of the ti&m digital banking suite formed the functional and technical basis for a customized solution to be developed in close collaboration with VZ VermögensZentrum, taking into account the customer’s legacy as well as their requirements.

Financial Portal Pro: an innovative joint project

Interest from private customers in trading has grown strongly in the last few years, not least due to the emergence of cryptocurrencies. In addition to the new financial portal, where customers can go about their usual banking business, VZ VermögensZentrum wanted to give its customers easy access to the trading world by means of a new platform. In a joint innovation project by ti&m and VZ VermögensZentrum, the Financial Portal Pro was created, a trading platform that combines numerous functions and infotainment features in a unique UX. The user-friendly interface and broad set of features offers newcomers an easy introduction to the world of trading and gives professionals tools that can rival any neobank trading app: The integration of finance and news portals offers news and insights into markets and specific securities, while market information on different assets such as shares, interest rates and currencies, as well as portfolio reviews, can be viewed in real time. Users have the opportunity to set up their own trading platform as they wish, by adding or removing specific modules using the drag ‘n’ drop function. In addition, assets can be displayed according to user-defined parameters: view by asset class, by development for the current day, by historical performance, or as a detailed list of positions. Like the Financial Portal, the Financial Portal Pro was developed using an open architecture: Existing solutions by WebFG and TradingView are already integrated into the platform, while further frontend modules, so-called widgets, can be developed by various parties without any specific technical specifications and made available to the user having been registered centrally in a repository. Last but not least, a seamless connection to the core banking system reduces pressure on the back office. While the Financial Portal Pro project was being implemented, the newly developed solution was packaged into a new product: the ti&m trading suite. Following the successful introduction at VZ VermögensZentrum, ti&m’s modular Trading Suite, which takes just a few months to launch and seamlessly integrate into existing software environments, is also available to other financial service providers.

Digital onboarding: fast and secure new customer registration based on the ti&m onboarding suite

A customer’s first contact with their bank is crucial. When working from home, digital natives expect a smooth, simple and fully digital onboarding process. In a third stage, the ti&m onboarding solution was therefore rolled out for new customers and insurance customers who do not yet have an account with VZ VermögensZentrum. The entire end-to-end online identification process, with document scan and liveness check, is fully automated and AI-supported. The next step for VZ VermögensZentrum is to conduct a compliance check (checking compliance with anti-money laundering regulations and guidelines concerning politically exposed persons), and to decide whether or not they wish to accept the new customer. Lastly, the contracts for opening an account are issued via the in-house contract platform and shown to the customer. If the customer agrees, these can be signed digitally by timestamp. Particularly for banks, digitalization and the automation of the resource-intensive new customer registration process offers a wealth of potential.

The onboarding solution implemented for VZ VermögensZentrum is based on the ti&m onboarding suite. Online identification is available in two versions: As a fully automated online ID service, as in the case of the implementation for VZ VermögensZentrum, or as a video ID service, in which a bank employee or call center verifies identity via video call.

Als Beispiel für Digitalisierung von Banken gilt das Finanzportal Pro: ein innovatives Gemeinschaftsprojekt

A study by the Institute of Financial Services Zug (IFZ) atLucerne University of Applied Sciences and Arts has ranked VZ VermögensZentrum as one of the best retail banks for digital services. A new entrant, the Swiss financial services provider made the top 10 for digitalization. Working closely with VZ VermögensZentrum, ti&m implemented the new, expanded digital offering based on existing e-banking and onboarding products; a new and innovative trading platform was also developed for the Financial Portal Pro.

Financial Portal: the individual ti&m digital banking suite for VZ VermögensZentrum

The first part of the digitalization strategy was to refresh the existing e-banking solution. VZ VermögensZentrum had a varied range of products and services that it wanted to supply to its customers digitally. Similarly to other projects, ti&m pursued a consistent front-to-back approach over the 12-month implementation period: The benefit, usability and the range of functions for end users were at the forefront. The new VZ VermögensZentrum Financial Portal is a modern e-banking portal offering numerous self-service functionalities and a clear and intuitive UX for smartphones and desktops. For ti&m, front-to-back also means separating the core banking system with the front end. This is the only way to respond promptly to market changes and new customer requirements, through the simple integration of new modules and third-party services. The open architecture enables new features to be implemented in a rapid time-to-market and lays the foundation for future-proof multi-banking services in a changing financial world. The modular product range of the ti&m digital banking suite formed the functional and technical basis for a customized solution to be developed in close collaboration with VZ VermögensZentrum, taking into account the customer’s legacy as well as their requirements.

Financial Portal Pro: an innovative joint project

Interest from private customers in trading has grown strongly in the last few years, not least due to the emergence of cryptocurrencies. In addition to the new financial portal, where customers can go about their usual banking business, VZ VermögensZentrum wanted to give its customers easy access to the trading world by means of a new platform. In a joint innovation project by ti&m and VZ VermögensZentrum, the Financial Portal Pro was created, a trading platform that combines numerous functions and infotainment features in a unique UX. The user-friendly interface and broad set of features offers newcomers an easy introduction to the world of trading and gives professionals tools that can rival any neobank trading app: The integration of finance and news portals offers news and insights into markets and specific securities, while market information on different assets such as shares, interest rates and currencies, as well as portfolio reviews, can be viewed in real time. Users have the opportunity to set up their own trading platform as they wish, by adding or removing specific modules using the drag ‘n’ drop function. In addition, assets can be displayed according to user-defined parameters: view by asset class, by development for the current day, by historical performance, or as a detailed list of positions. Like the Financial Portal, the Financial Portal Pro was developed using an open architecture: Existing solutions by WebFG and TradingView are already integrated into the platform, while further frontend modules, so-called widgets, can be developed by various parties without any specific technical specifications and made available to the user having been registered centrally in a repository. Last but not least, a seamless connection to the core banking system reduces pressure on the back office. While the Financial Portal Pro project was being implemented, the newly developed solution was packaged into a new product: the ti&m trading suite. Following the successful introduction at VZ VermögensZentrum, ti&m’s modular Trading Suite, which takes just a few months to launch and seamlessly integrate into existing software environments, is also available to other financial service providers.

Digital onboarding: fast and secure new customer registration based on the ti&m onboarding suite

A customer’s first contact with their bank is crucial. When working from home, digital natives expect a smooth, simple and fully digital onboarding process. In a third stage, the ti&m onboarding solution was therefore rolled out for new customers and insurance customers who do not yet have an account with VZ VermögensZentrum. The entire end-to-end online identification process, with document scan and liveness check, is fully automated and AI-supported. The next step for VZ VermögensZentrum is to conduct a compliance check (checking compliance with anti-money laundering regulations and guidelines concerning politically exposed persons), and to decide whether or not they wish to accept the new customer. Lastly, the contracts for opening an account are issued via the in-house contract platform and shown to the customer. If the customer agrees, these can be signed digitally by timestamp. Particularly for banks, digitalization and the automation of the resource-intensive new customer registration process offers a wealth of potential.

The onboarding solution implemented for VZ VermögensZentrum is based on the ti&m onboarding suite. Online identification is available in two versions: As a fully automated online ID service, as in the case of the implementation for VZ VermögensZentrum, or as a video ID service, in which a bank employee or call center verifies identity via video call.

Innovation durch neue Online Trading Plattform

A study by the Institute of Financial Services Zug (IFZ) atLucerne University of Applied Sciences and Arts has ranked VZ VermögensZentrum as one of the best retail banks for digital services. A new entrant, the Swiss financial services provider made the top 10 for digitalization. Working closely with VZ VermögensZentrum, ti&m implemented the new, expanded digital offering based on existing e-banking and onboarding products; a new and innovative trading platform was also developed for the Financial Portal Pro.

Financial Portal: the individual ti&m digital banking suite for VZ VermögensZentrum

The first part of the digitalization strategy was to refresh the existing e-banking solution. VZ VermögensZentrum had a varied range of products and services that it wanted to supply to its customers digitally. Similarly to other projects, ti&m pursued a consistent front-to-back approach over the 12-month implementation period: The benefit, usability and the range of functions for end users were at the forefront. The new VZ VermögensZentrum Financial Portal is a modern e-banking portal offering numerous self-service functionalities and a clear and intuitive UX for smartphones and desktops. For ti&m, front-to-back also means separating the core banking system with the front end. This is the only way to respond promptly to market changes and new customer requirements, through the simple integration of new modules and third-party services. The open architecture enables new features to be implemented in a rapid time-to-market and lays the foundation for future-proof multi-banking services in a changing financial world. The modular product range of the ti&m digital banking suite formed the functional and technical basis for a customized solution to be developed in close collaboration with VZ VermögensZentrum, taking into account the customer’s legacy as well as their requirements.

Financial Portal Pro: an innovative joint project

Interest from private customers in trading has grown strongly in the last few years, not least due to the emergence of cryptocurrencies. In addition to the new financial portal, where customers can go about their usual banking business, VZ VermögensZentrum wanted to give its customers easy access to the trading world by means of a new platform. In a joint innovation project by ti&m and VZ VermögensZentrum, the Financial Portal Pro was created, a trading platform that combines numerous functions and infotainment features in a unique UX. The user-friendly interface and broad set of features offers newcomers an easy introduction to the world of trading and gives professionals tools that can rival any neobank trading app: The integration of finance and news portals offers news and insights into markets and specific securities, while market information on different assets such as shares, interest rates and currencies, as well as portfolio reviews, can be viewed in real time. Users have the opportunity to set up their own trading platform as they wish, by adding or removing specific modules using the drag ‘n’ drop function. In addition, assets can be displayed according to user-defined parameters: view by asset class, by development for the current day, by historical performance, or as a detailed list of positions. Like the Financial Portal, the Financial Portal Pro was developed using an open architecture: Existing solutions by WebFG and TradingView are already integrated into the platform, while further frontend modules, so-called widgets, can be developed by various parties without any specific technical specifications and made available to the user having been registered centrally in a repository. Last but not least, a seamless connection to the core banking system reduces pressure on the back office. While the Financial Portal Pro project was being implemented, the newly developed solution was packaged into a new product: the ti&m trading suite. Following the successful introduction at VZ VermögensZentrum, ti&m’s modular Trading Suite, which takes just a few months to launch and seamlessly integrate into existing software environments, is also available to other financial service providers.

Digital onboarding: fast and secure new customer registration based on the ti&m onboarding suite

A customer’s first contact with their bank is crucial. When working from home, digital natives expect a smooth, simple and fully digital onboarding process. In a third stage, the ti&m onboarding solution was therefore rolled out for new customers and insurance customers who do not yet have an account with VZ VermögensZentrum. The entire end-to-end online identification process, with document scan and liveness check, is fully automated and AI-supported. The next step for VZ VermögensZentrum is to conduct a compliance check (checking compliance with anti-money laundering regulations and guidelines concerning politically exposed persons), and to decide whether or not they wish to accept the new customer. Lastly, the contracts for opening an account are issued via the in-house contract platform and shown to the customer. If the customer agrees, these can be signed digitally by timestamp. Particularly for banks, digitalization and the automation of the resource-intensive new customer registration process offers a wealth of potential.

The onboarding solution implemented for VZ VermögensZentrum is based on the ti&m onboarding suite. Online identification is available in two versions: As a fully automated online ID service, as in the case of the implementation for VZ VermögensZentrum, or as a video ID service, in which a bank employee or call center verifies identity via video call.

Digitales Onboarding: schnelle und sichere Neukundenregistrierung auf Grundlage der ti&m onboarding suite

A study by the Institute of Financial Services Zug (IFZ) atLucerne University of Applied Sciences and Arts has ranked VZ VermögensZentrum as one of the best retail banks for digital services. A new entrant, the Swiss financial services provider made the top 10 for digitalization. Working closely with VZ VermögensZentrum, ti&m implemented the new, expanded digital offering based on existing e-banking and onboarding products; a new and innovative trading platform was also developed for the Financial Portal Pro.

Financial Portal: the individual ti&m digital banking suite for VZ VermögensZentrum

The first part of the digitalization strategy was to refresh the existing e-banking solution. VZ VermögensZentrum had a varied range of products and services that it wanted to supply to its customers digitally. Similarly to other projects, ti&m pursued a consistent front-to-back approach over the 12-month implementation period: The benefit, usability and the range of functions for end users were at the forefront. The new VZ VermögensZentrum Financial Portal is a modern e-banking portal offering numerous self-service functionalities and a clear and intuitive UX for smartphones and desktops. For ti&m, front-to-back also means separating the core banking system with the front end. This is the only way to respond promptly to market changes and new customer requirements, through the simple integration of new modules and third-party services. The open architecture enables new features to be implemented in a rapid time-to-market and lays the foundation for future-proof multi-banking services in a changing financial world. The modular product range of the ti&m digital banking suite formed the functional and technical basis for a customized solution to be developed in close collaboration with VZ VermögensZentrum, taking into account the customer’s legacy as well as their requirements.

Financial Portal Pro: an innovative joint project

Interest from private customers in trading has grown strongly in the last few years, not least due to the emergence of cryptocurrencies. In addition to the new financial portal, where customers can go about their usual banking business, VZ VermögensZentrum wanted to give its customers easy access to the trading world by means of a new platform. In a joint innovation project by ti&m and VZ VermögensZentrum, the Financial Portal Pro was created, a trading platform that combines numerous functions and infotainment features in a unique UX. The user-friendly interface and broad set of features offers newcomers an easy introduction to the world of trading and gives professionals tools that can rival any neobank trading app: The integration of finance and news portals offers news and insights into markets and specific securities, while market information on different assets such as shares, interest rates and currencies, as well as portfolio reviews, can be viewed in real time. Users have the opportunity to set up their own trading platform as they wish, by adding or removing specific modules using the drag ‘n’ drop function. In addition, assets can be displayed according to user-defined parameters: view by asset class, by development for the current day, by historical performance, or as a detailed list of positions. Like the Financial Portal, the Financial Portal Pro was developed using an open architecture: Existing solutions by WebFG and TradingView are already integrated into the platform, while further frontend modules, so-called widgets, can be developed by various parties without any specific technical specifications and made available to the user having been registered centrally in a repository. Last but not least, a seamless connection to the core banking system reduces pressure on the back office. While the Financial Portal Pro project was being implemented, the newly developed solution was packaged into a new product: the ti&m trading suite. Following the successful introduction at VZ VermögensZentrum, ti&m’s modular Trading Suite, which takes just a few months to launch and seamlessly integrate into existing software environments, is also available to other financial service providers.

Digital onboarding: fast and secure new customer registration based on the ti&m onboarding suite

A customer’s first contact with their bank is crucial. When working from home, digital natives expect a smooth, simple and fully digital onboarding process. In a third stage, the ti&m onboarding solution was therefore rolled out for new customers and insurance customers who do not yet have an account with VZ VermögensZentrum. The entire end-to-end online identification process, with document scan and liveness check, is fully automated and AI-supported. The next step for VZ VermögensZentrum is to conduct a compliance check (checking compliance with anti-money laundering regulations and guidelines concerning politically exposed persons), and to decide whether or not they wish to accept the new customer. Lastly, the contracts for opening an account are issued via the in-house contract platform and shown to the customer. If the customer agrees, these can be signed digitally by timestamp. Particularly for banks, digitalization and the automation of the resource-intensive new customer registration process offers a wealth of potential.

The onboarding solution implemented for VZ VermögensZentrum is based on the ti&m onboarding suite. Online identification is available in two versions: As a fully automated online ID service, as in the case of the implementation for VZ VermögensZentrum, or as a video ID service, in which a bank employee or call center verifies identity via video call.